How to Choose an ESG Reporting Framework: a Decision Making Tool

The alphabet soup of Environmental, Social and Governance (ESG) frameworks and standards - GRI, SASB, TCFD, CDP, SDGs and <IR> - can be confusing and overwhelming. Thankfully, the entities that created the frameworks and other international bodies have started to explore the possibilities to harmonize the existing frameworks. If successful, these efforts should make it easier for reporters to align with more universal principles and standards and for investors and other stakeholders to compare reports. In the meantime, we’ve created a tool that can help companies decide which framework(s) provide the best fit for their unique circumstances.

The ESG Reporting Landscape

In 2019, 90% of S&P 500 companies voluntarily published sustainability reports, the highest proportion since ESG reporting began, according to a 2020 report by the Governance and Accountability Institute (G&A). That report also revealed that of the S&P 500 companies reporting in 2019, half used the GRI Standards, 25% used SASB, 65% used CDP, 16% used TCFD, and 36% aligned with specific UN Sustainable Development Goals. The table below highlights the most commonly used ESG or sustainability frameworks and standards.

Will These Standards Become Mandatory? Will They Converge?

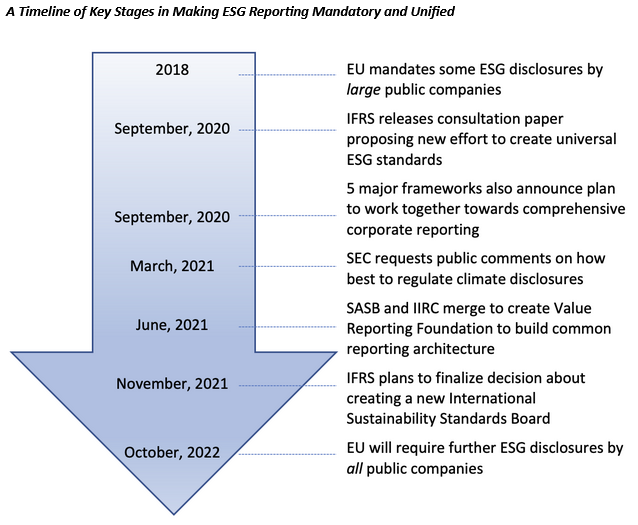

The disclosure community is keenly aware of two trends in this space: the growing momentum for governments to require ESG reporting and the need to harmonize the overlapping frameworks. The following figure summarizes the most significant efforts underway to make ESG reporting either mandatory or more standardized across sectors and jurisdictions.

The primary effort to harmonize ESG standards we are watching right now is spearheaded by the International Financial Reporting Standards (IFRS) Foundation. The IFRS is a non-profit public interest organization with a mission to develop a single set of globally-accepted accounting principles. Adherence to these principles is required for all or most companies in 144 jurisdictions around the world. At the same time as the IFRS ESG initiative was announced, the entities that oversee the five major ESG reporting frameworks (CDP, CDSB, GRI, IIRC, and SASB) released a “Statement of Intent to Work Together Towards Comprehensive Corporate Reporting.” A more detailed description of these efforts is available in our recent white paper.

How to Decide on a Framework

Until a system of uniform disclosures emerges, the reporting landscape can feel a bit like the “wild west” to both those disclosing and those analyzing disclosures. As a result, one of the most frequent questions we receive from our business sector clients is which framework or standard they should use to shape their sustainability strategies, goals, and public disclosures.

Companies should consider several factors in choosing an ESG framework(s), including the company’s sector, size, location, workforce makeup, ownership structure and resources. To assist companies in sorting through the frameworks, we developed a set of questions and a simple tool that can serve as a starting point in the process. Note that this tool can lead companies to multiple answers and there will likely still be a need to have an in-depth discussion about which framework(s) will work for a company’s unique needs. A deeper discussion of the components of this decision tree can be found in our recent white paper.

ESG Framework Decision Tree for Public Companies

Conclusion

SustainabilityNext’s Decision Tree can help a company narrow its choices when considering appropriate ESG reporting frameworks. Whichever direction you choose to pursue with ESG reporting, the process will likely benefit your company as the world moves inevitably closer to standardizing and potentially requiring ESG reporting.

The SustainabilityNext team stands ready to provide guidance on ESG frameworks, materiality assessments and stakeholder engagement for your company. You can contact us at ann@sustainabilitynxt.com.